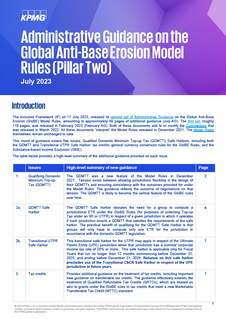

The OECD/G20 Inclusive Framework on BEPS reached agreement on the Pillar Two global minimum tax rules in October 2021, putting out model rules in December 2021, commentary in March 2022, and further administrative guidance in February 2023. These new Global Anti-Base Erosion (GloBE) rules are now being implemented by jurisdictions around the world and will apply to many companies from 2024. Multinational companies need to stay abreast of these developments to navigate and prepare successfully for the changes in the global tax landscape.

You'll find insights from KPMG about these developments on this page.

.pdf/_jcr_content/renditions/cq5dam.thumbnail.319.319.png)