Pillar Two Implementation: Progress Around the World

International Tax Team video series – Overview of the impact of the OECD’s Pillar Two initiative on U.S. multinational groups (part 2)

February 17, 2023 | In this video, Marcus Heyland, a managing director with the KPMG Washington National Tax practice and former OECD adviser, Chris Wilson, a director with KPMG in the United Kingdom currently seconded to KPMG in the United States, and Martin Baltes, a partner with KPMG in Germany and also seconded to the United States, update viewers on Pillar Two implementation in key jurisdictions around the world as well as the related technical work at the OECD. Combined with insights on the potential impact on U.S. multinationals, they provide:

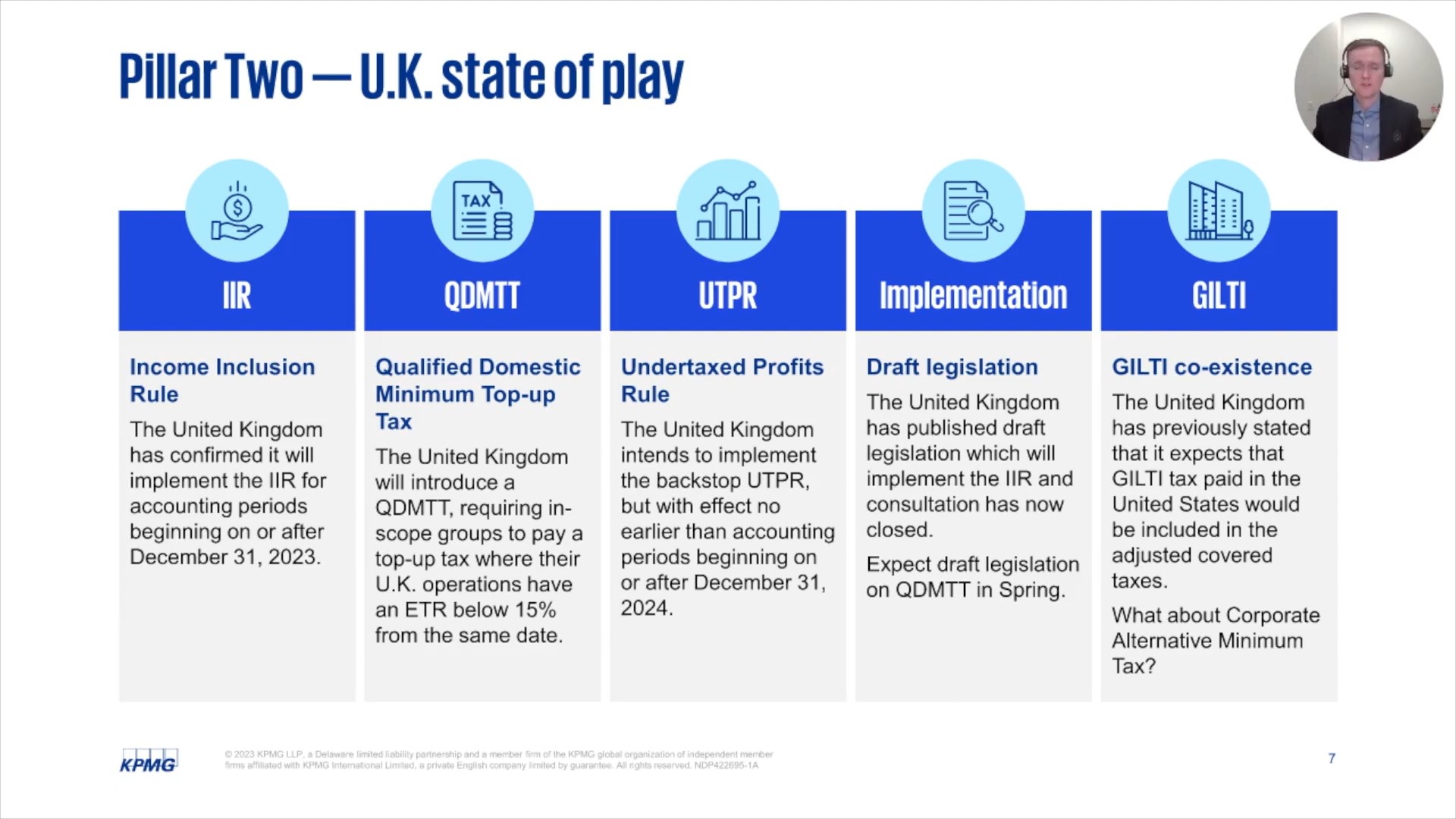

- An update on global announcements and progress toward implementation in select countries

- Drill downs on the implementation status in the related European Union and the United Kingdom

- An overview of the December OECD Implementation Package, including an overview of the Information Return and safe harbors.

This 18-minute video was recorded on January 26, 2023.

Explore more

Meet our team

Marcus Heyland

Principal, Washington National Tax, KPMG US

Chris Wilson

Tax Director, KPMG UK-US Tax Corridor, KPMG US

Martin Baltes

Seconded Partner, Head of Germany Tax Center, KPMG US