New Trade Rules and Import Compliance Trends on the E-Commerce Horizon

Companies with cross-border e-commerce transactions should be aware of proposed changes and anticipate the impact to their business.

As e-commerce and cross-border sales are increasing, so too is trade enforcement

Since the advent of electronic commerce (“e-commerce”) platforms, regulators and legislators around the world have been grappling with new customs compliance and security risks, as well as the environmental, social, and corporate governance (“ESG”) concerns that arise from the cross-border movement of goods purchased through these platforms. In the United States, the response has been the proposal of new laws to address these issues. Companies with cross-border e-commerce transactions should be aware of these proposed changes and anticipate the impact to their businesses to mitigate potentially adverse consequences.

Read the report to learn more about:

- Background on imports via e-commerce

- Recently enacted legislation and legislative proposals

- Importance of proactively managing forced labor risks

- The OECD Task Force on Countering Illicit Trade

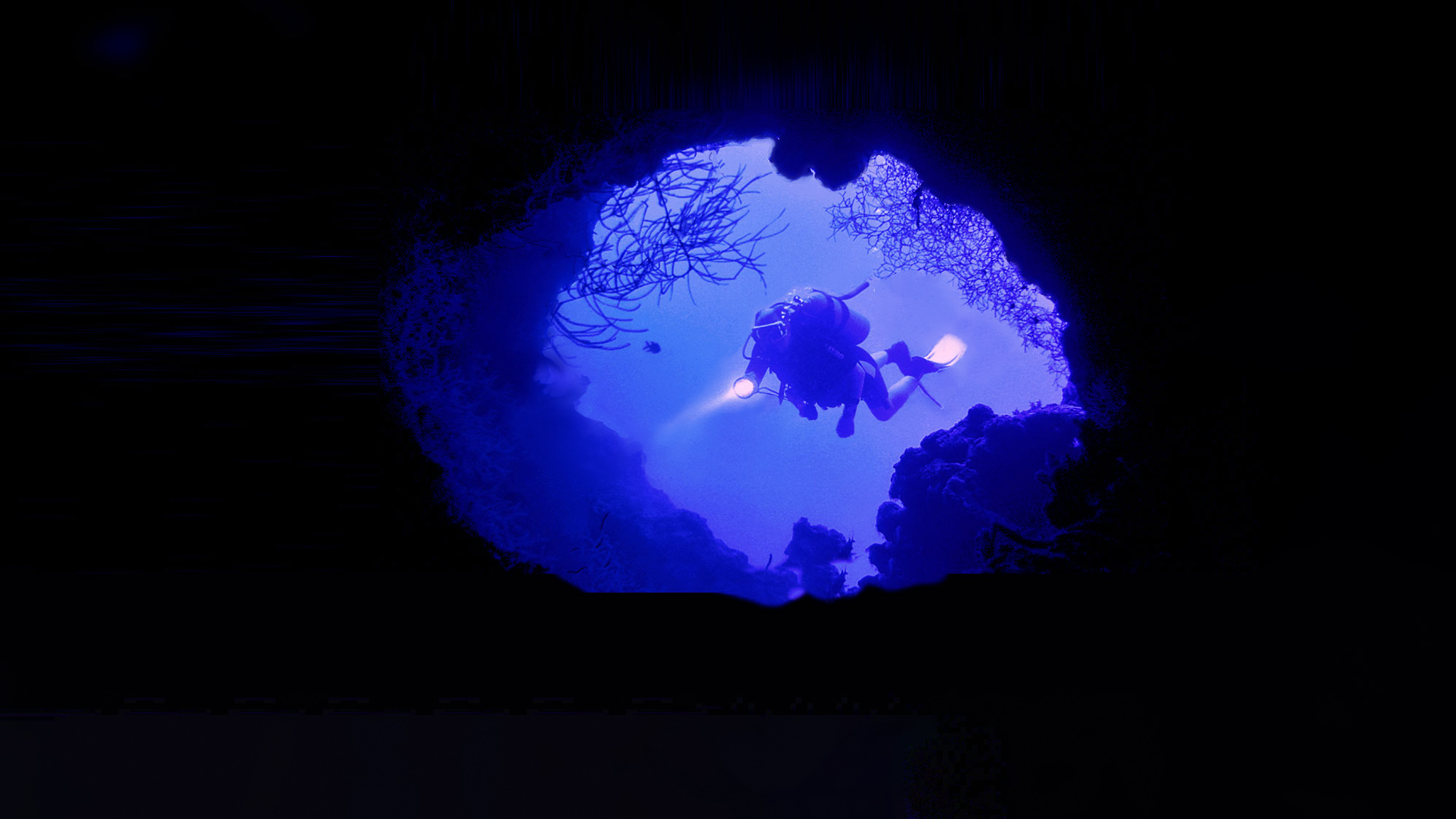

Dive into our thinking:

New Trade Rules and Import Compliance Trends on the E-Commerce Horizon

June 2022 | Companies with cross-border transactions should be aware of proposed changes and new legislation that look to address a variety risks associated with customs compliance and security, and corporate governance (ESG) concerns as they apply to the cross-border movement of goods purchased through e-commerce.

Download PDFExplore more

Be ready for disruption - tax insights

Tax insights and analysis to help organizations respond with speed and confidence

Meet our team